Financial diversity: Flexibility for your financial needs

Trusted mortgage advice

Mortgage Advice Bureau will compare thousands of mortgages from 90+ lenders. These include Barclays, Santander, NatWest, and Halifax. They'll find the best deal for you.

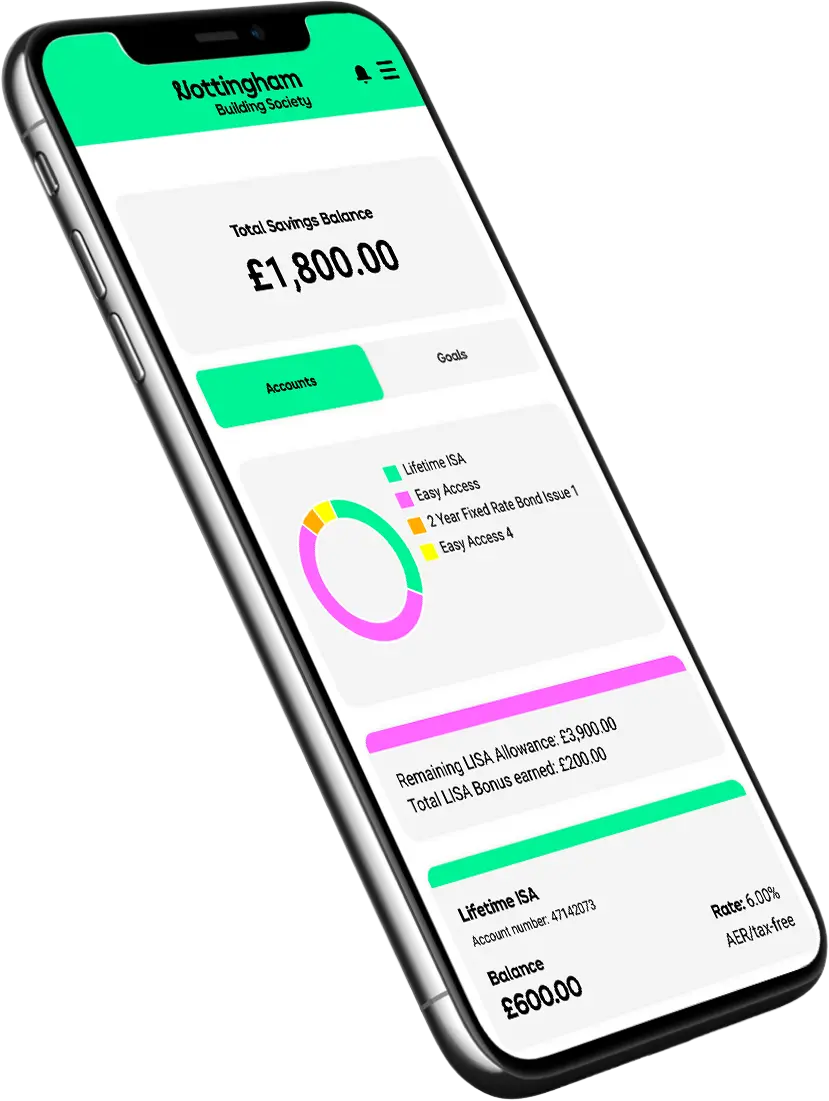

Savings accounts

Get cash ISAs, fixed-rate savers, easy-access and regular savings accounts. Plus, children's savers to help your little ones get started.

Already mortgaged with us?

Find info about your Nottingham Building Society mortgage. It covers switching deals, additional borrowing and making an overpayment.

Find your nearest branch

If you'd prefer to speak with us face-to-face, you’re always welcome at your local branch. Use our postcode checker to find one in your area.

Contact us

Our Nottingham-based customer care colleagues are happy to help you, and you can contact us in many ways.

Help and support

Search our help and support guides for our products and services or find information you need in our frequently asked questions.

Our passbooks are here to stay

Unlike other banks and building societies, we're committed to our passbooks, so you can save exactly how you want to.

Fraud and security

Become aware of the latest scams, learn how you can protect yourself against fraud and stay safe online. Also, see what we do to protect you and your money.

What is financial diversity?

When we talk about financial diversity this is what we mean: very simply, that we all have financial needs and personal circumstances that are ever evolving.