Enhancements to our app | March 2025

We're always looking at ways to enhance our app, from enhancing journeys and publishing new functionality, to working with new partners to deliver you additional services. Take a look at the changes that were published on 11th March 2025.

Lowered opening balances

Since we launched online products we've been unable to offer accounts with different opening balances, something we know is important to our members who have varied savings goals. We've lowered the opening balance on a range of accounts to make them more accessible for our members' needs.

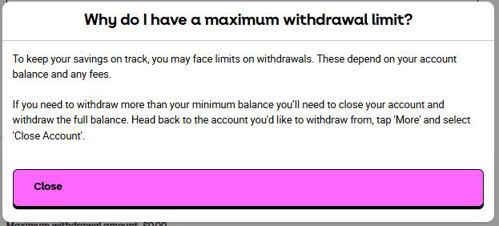

Full balance withdrawal information

After launching our 'in-app feedback' feature, we were told that members are getting stuck when trying to withdraw their full balance. This is often because of account limitations whereby you must keep a certain amount in the account for it to remain open.

We've created a pop-up when full balance withdrawals are made to give our members a bit more help.

Identification enhancements

We use an automated identity validation system, provided by Onfido, to help members apply for a new account, so you can open an account with as little hassle as possible by simply sending us a selfie in the app. We have recently

- Introduced additional validation checks that reduces errors when confirming your identity. We're pleased that this improves overall accuracy of facial recognition.

- Upgraded the 'known faces' report. This provides us with more detailed and insightful data for facial recognition checks.

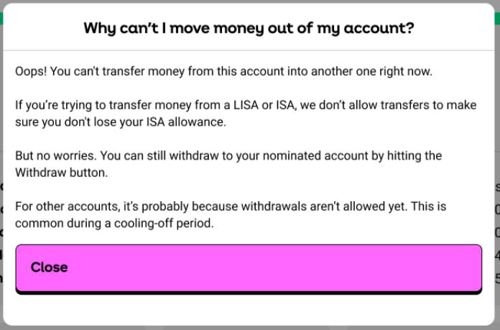

More protection for your tax-free bonus

Similar to the full balance withdrawal pop up, we've created another that notifies members who are trying to but cannot transfer funds from one Nottingham savings account to another. This may be because we don't want it to affect your ISA allowance or it's a fixed rate product.